Get the free pa 1000 instructions form

Show details

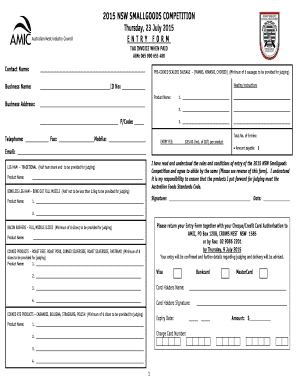

PA SCHEDULE D/E/F PA-1000 D/E/F (08 11) PA Department of Revenue START 1105520017 2011 OFFICIAL USE ONLY Name as shown on PA-1000 Social Security Number You may make photocopies of this form as needed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your pa 1000 instructions form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa 1000 instructions form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pa 1000 instructions online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pa 1000 instructions 2023 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

How to fill out pa 1000 instructions form

How to fill out pa 1000 instructions:

01

Start by carefully reviewing the instructions provided with the pa 1000 form. It is important to understand the requirements and any specific guidelines for completion.

02

Gather all the necessary information and documentation required for filling out the pa 1000 form. This may include your personal and financial information, such as income statements, tax forms, and property details.

03

Begin filling out the form step-by-step, providing accurate and complete information for each section. Double-check your entries for any errors or omissions.

04

If you have any questions or uncertainties while filling out the form, refer to the instructions or seek assistance from a tax professional or the appropriate government agency.

05

Once you have completed all the required sections of the pa 1000 form, review it again to ensure accuracy and completeness. Make sure you have signed and dated the form as required.

06

Submit the completed pa 1000 form to the designated government agency or follow the instructions provided for submission. Retain a copy of the form for your records.

Who needs pa 1000 instructions:

01

Individuals or households who own property in the state where the pa 1000 form is required. This may include homeowners, landlords, or property owners who qualify for specific tax relief or exemption programs.

02

Anyone who has received the pa 1000 form from the relevant government agency, indicating the need to fill it out. It is important to comply with the instructions and requirements outlined in the form to meet the legal obligations related to property taxation.

Fill schedule of pa 1000 : Try Risk Free

People Also Ask about pa 1000 instructions

What do you need for PA rent rebate?

Is it too late to file for rent rebate in PA?

What age do you stop paying property taxes in pa?

How long does it take to process rent rebate in PA?

How do I prove my age for property tax rebate in pa?

What is the property tax rebate for 2023 in pa?

What documents do I need for rent rebate in PA?

How much do you get back for a rent rebate in PA?

What is the rent rebate for 2023 in PA?

Who qualifies for PA property tax rebate?

At what age do seniors stop paying property taxes in Pennsylvania?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file pa 1000 instructions?

The Pennsylvania Department of Revenue requires all individuals and businesses who have a taxable income of more than $33 or more in a year to file a PA-1000 Personal Income Tax Return.

How to fill out pa 1000 instructions?

PA 1000 Instructions

1. Enter your name and address information in the appropriate boxes.

2. Enter the name of the taxpayer and the taxpayer's social security number in the appropriate boxes.

3. Enter the tax year for which you are filing the form in the appropriate box.

4. Enter the total of your Pennsylvania taxable income on Line 1.

5. Enter your Pennsylvania income tax withholding on Line 2.

6. Enter the total of any payments you have already made on Line 3.

7. Enter the total of any estimated payments you have already made on Line 4.

8. Enter any tax credits you are claiming on Line 5.

9. Calculate the total tax due by subtracting Lines 3, 4, and 5 from Line 1.

10. Enter the total tax due from Line 6 on Line 7.

11. Sign and date the form.

12. Attach any necessary documentation.

13. Mail the form and payment to the address listed on the form.

What information must be reported on pa 1000 instructions?

For PA 1000 Instructions, the following information must be reported:

1. Name and address of the taxpayer

2. Taxpayer identification number

3. Tax period for which the return is being filed

4. Amount of tax due

5. Payment Options

6. Filing Deadline

7. Contact information for the Pennsylvania Department of Revenue

When is the deadline to file pa 1000 instructions in 2023?

The deadline to file PA 1000 instructions for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of pa 1000 instructions?

The penalty for the late filing of PA 1000 instructions is a minimum penalty of $50 or 20% of the tax due, whichever is greater.

What is pa 1000 instructions?

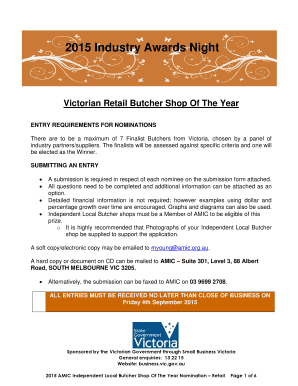

The PA 1000 instructions refer to the instructions provided by the Pennsylvania Department of Revenue for completing the PA 1000 Property Tax or Rent Rebate Program application. These instructions provide step-by-step guidance on how to accurately fill out the application form and apply for property tax or rent rebates for eligible Pennsylvania residents.

What is the purpose of pa 1000 instructions?

The purpose of PA 1000 instructions is to provide taxpayers in Pennsylvania with clear and detailed guidelines on how to file their Pennsylvania personal income tax returns. These instructions explain the tax laws, regulations, and procedures that individuals need to follow in order to accurately report their income, claim deductions or credits, and determine their tax liability. The PA 1000 instructions also provide information on any recent changes to the tax laws, answer frequently asked questions, and offer tips for minimizing errors and avoiding penalties. The instructions serve as a comprehensive resource for taxpayers to understand their obligations and to complete their tax returns correctly.

How do I complete pa 1000 instructions online?

pdfFiller has made it simple to fill out and eSign pa 1000 instructions 2023 form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in pa1000 instructions?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your pa rent certificate instructions to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I edit pa1000 instructions 2023 on an iOS device?

Create, edit, and share what documents do i need for rent rebate in pa form from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your pa 1000 instructions form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

pa1000 Instructions is not the form you're looking for?Search for another form here.

Keywords relevant to pa1000 form

Related to pa rent rebate instructions 2020

If you believe that this page should be taken down, please follow our DMCA take down process

here

.